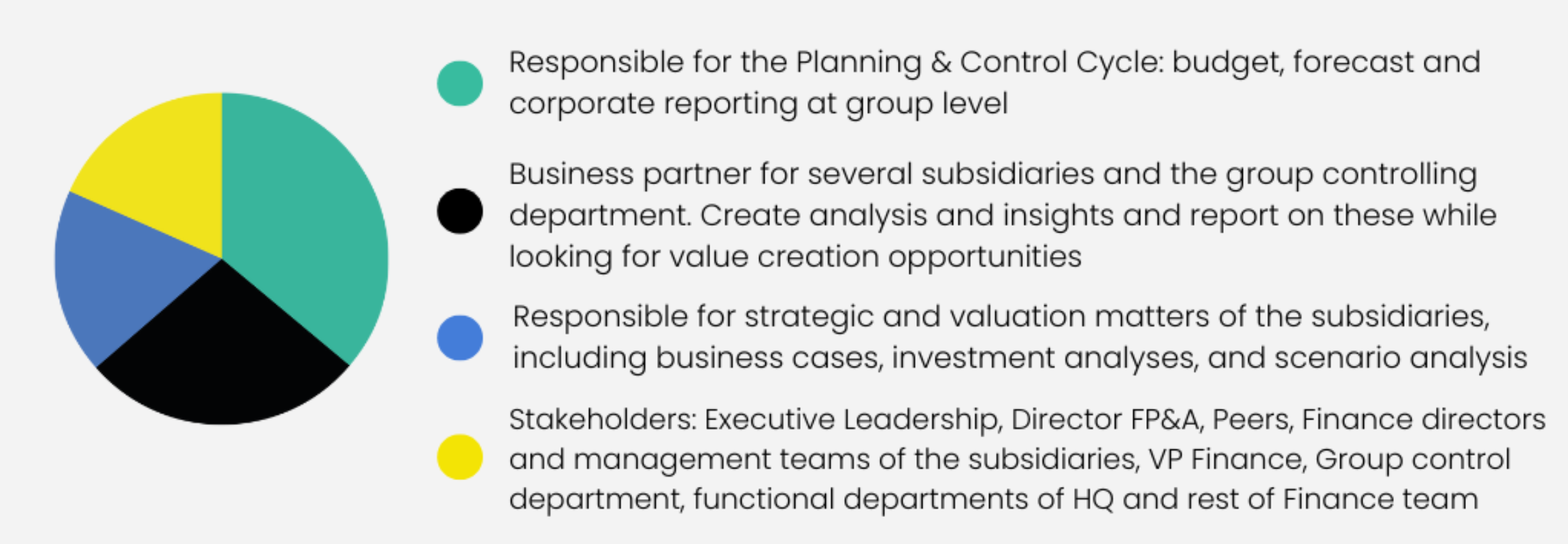

In this role you will be the finance business partner for financial and controlling matters between various subsidiaries and the Group Controlling Department. You will create analysis and insights and report on these while together with the subsidiaries look for opportunities to increase value creation. Your work will help maintain the integrity of our financial operations and support informed decision making across the organisation.

In this role you will operate at the center of an international finance organisation, acting as the key link between selected subsidiaries and the Group Controlling Department. You will monitor and analyze financial performance across a portfolio, typically five subsidiaries per controller and expanding as the organisation grows, ensuring that reporting is accurate and value-driven. This includes financial and non-financial KPIs such as occupancy, service levels, profitability and operational insights. Throughout the budget and forecast cycles, you will support the global finance teams by reviewing P&L, balance sheets, cash flow and key operational metrics, and contribute to monthly Top Management reporting with insights on capital structure, planning and financing topics.

You will be working closely with the Finance Directors of the different subsidiaries and the FP&A team. You will translate data into recommendations that support both short-term priorities and long-term strategic goals. You will help optimize and standardize processes and reporting frameworks, including BI tools and management information. Your work feeds into business cases, strategic planning and business-review cycles, where you help assess performance and identify financial risks and opportunities. You will participate in improvement initiatives, validate business cases and strengthen decision-making through solid financial analysis. Collaboration with Group Accounting, Tax and Treasury ensures alignment across financial touchpoints. Together with your FP&A colleagues, you will contribute to consolidated reporting, execute ad-hoc analyses and remain flexible as responsibilities evolve in this dynamic and growing environment.

In addition to recurring responsibilities, you will support the evaluation of major investments such as the development of subsidiaries, the refinancing of an existing subsidiaries, or the addition of entire subsidiary by preparing and assessing business cases. As part of the company’s buy-and-build strategy, it is possible to support the M&A team when a new subsidiary or entities is launched or acquired.

The ideal candidate combines strong analytical with problem-solving abilities. You are a candidate with results-driven and a growth mindset which communicates clearly and confidently with stakeholders at all levels. They are curious, eager to learn and motivated to grow professionally, bringing high energy, low ego and a good sense of humor to their work. With a positive, team-oriented and can-do attitude, they thrive in a collaborative environment and build productive relationships across the organisation.

- Bachelor’s or Master’s degree in Finance, Accounting, Business Administration or a related field

- Around up to five years ’ experience in financial controlling, accounting, or a similar role

- Experience in an international environment is an advantage

- Experience within energy and/or chemical industry is a plus

- Excellent command of English (written and spoken); Dutch is an advantage

- Pro-active, hands-on mentality and ability to thrive in a dynamic, fast-paced environment

- Takes responsibility for tasks and sees them through to completion

- Working knowledge of SAP ERP, BPC and BI tools (Power BI) is an advantage

- Strong Excel and PowerPoint skills

- Ability to work independently when needed, with appropriate guidance