Building Beyond Technology Group (BBTG) began to take shape in 2025 when IceLake initiated a buy-and-build strategy to form an AI-first technology group through its first acquisition of Rubicon (March), closely followed by Navara / Harvest (May), OGD (July), Infiniot (November) and Bauhaus ArtITech (November). As BBTG continues to scale rapidly as a group, the need for clear insight, aligned performance steering and a unified financial operating model grows with it. As Group Business Controller, you will play a crucial role in this journey.

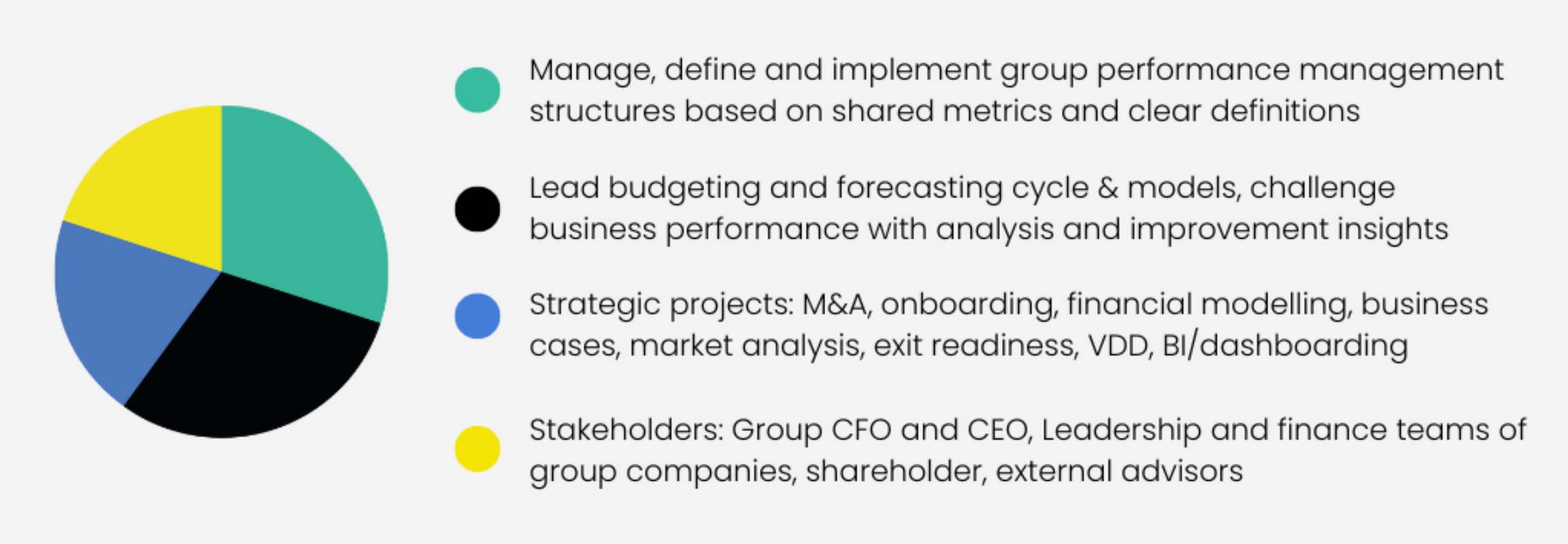

In this position, you report directly to the Group CFO and act as his right hand in building strong, unified group structures. You will have a strong working relationship with the CFOs, finance community and leadership teams within the acquired companies and will have direct exposure to the shareholders, lenders, external advisors and other stakeholders.

The BBTG group performance management and reporting structures will have to be set up at a level appropriate for a PE-backed platform and structured with a future exit process in mind. You take ownership of the consolidated management reporting, from monthly group updates for management and shareholders to recurring and ad-hoc analyses. To do so, you build and maintain a shared KPI framework and financial models, ensuring a uniform structure, shared metrics and clear definitions. You do this in close collaboration with the Group CFO and CFOs within the companies and support and guide colleagues across the Group in adopting the new structures.

You also play a central role in BBTG’s budgeting and forecasting cycles, shaping and maintaining a standardized planning template that is used consistently across all operating companies. Within this cycle, you review and challenge business performance with sharp and improvement insights.

You will be involved in the strategic process to continuously improve the operating model and financial structures, ensuring that underlying financial processes and systems within the companies are structured, comparable and scalable, enabling alignment on targets, utilizing synergies and scale and enabling the seamless integration of future acquisitions as the BBTG Group continues to grow.

Beyond setting up and managing the performance cycle, you drive key strategic finance initiatives that support BBTG’s long-term direction. You contribute to M&A activity through financial due diligence and by integrating newly acquired companies into the Group’s reporting and performance landscape. You develop financial models, scenario analyses and business cases that support strategic projects and investment decisions, and you carry out market and competitor analyses that help shape BBTG’s strategic agenda.

As the Group matures in the coming years, you will play an important role in exit readiness and VDD process.

You combine solid financial expertise with curiosity, energy and a hands-on way of working. You enjoy diving into data, creating structure and shaping reporting frameworks that scale with the organization. What motivates you is turning numbers into clear insights and partnering with teams across the business to drive performance. You approach challenges with a proactive, collaborative mindset and bring the ambition and eagerness to grow in a dynamic, buy-and-build environment.

“As a PE-backed buy-and-build platform, BBTG is on an ambitious growth trajectory, and this role places you at the heart of that transformation. You help shape the financial operating model of an organisation where finance, strategy and value creation intersect, working on the levers that drive the Group forward: reporting, performance steering, M&A, integration and strategic decision-making. Few roles offer such broad, high-impact exposure in a fast-evolving tech environment, creating a steep and rewarding learning curve for your development.”

- A degree in business economics, accounting, business management or a related field.

- 4–6 years of relevant experience.

- Preferably experience in Transaction Advisory Services (Big 4) and/or in a financial analyst or controller role in an international technology or services environment.

- Experience with multi-entity or business line reporting, budgets, rolling forecasts, multi-year plans and financial modelling.

- Hand-on experience preparing finanial models and performance reports, combining financial and operational metrics, with insightful analyses and commentary.

- Strong business acumen and a solid financial foundation, from balance sheets and cash flows to journal entries, cost centres and consolidation.

- A solid grasp of core finance processes (P2P, O2C, payroll, etc.) and relevant financial metrics.

- Advanced Excel and PowerPoint skills, and ideally experience with Power BI.

- A data-driven, analytical and process-minded approach with strong affinity for financial systems.

- Fluent in English and Dutch.

- An eye for detail while keeping the bigger picture in view.

- A proactive, collaborative attitude, equally comfortable engaging stakeholders or working independently to deliver high-quality results on time.

- A growth mindset: energetic, ambitious and eager to learn.

Building Beyond Technology Group (BBTG) is a PE-backed, AI-first technology powerhouse created in 2025. Rooted in the Netherlands, with one strong ambition: to design, build, run, and evolve digital solutions on leading cloud platforms. Together they have the ambition to become a leading European partner for mission-critical Cloud, Digital and AI transformation. The Group serves enterprise clients in the public domain, financial services, energy, utilities and other regulated sectors, where reliability, security and scale are essential.

A Fast-Scaling Platform of Tech Specialists

Supported by IceLake Capital, BBTG unites several leading Dutch technology companies, including Rubicon (acquired March 2025), Navara / Harvest (acquired May 2025), OGD (acquired July 2025), Infiniot (acquired November 2025) and Bauhaus ArtITech (acquired November 2025). The platform has scaled rapidly; combined annual revenue is now approaching € 200 million, supported by a workforce of more than 2,000 employees. This scale, combined with the Group’s AI-first strategy, positions BBTG as one of the fastest-growing technology platforms with further acquisitions expected as the

buy-and-build strategy continues.

Leadership & Organization

BBTG is led by Arno Börger (Group CEO) and Rob Blasman (Group CFO). Operating companies retain their own Managing Directors and leadership teams, while the Group builds shared processes, systems and governance to support integration, operational excellence and cross-company collaboration across cloud, software, data, AI and cyber security practices.